Features

Finance

Management

4 of the best financial record keeping tips for RMTs

Massage therapists have standards they need to be aware of. The regulated provinces have colleges that set guidelines and standards of practice that must be maintained.

July 20, 2018 By Andrea Collins

Massage therapists have standards they need to be aware of. The regulated provinces have colleges that set guidelines and standards of practice that must be maintained.

Massage therapists have standards they need to be aware of. The regulated provinces have colleges that set guidelines and standards of practice that must be maintained.Massage therapists have standards they need to be aware of. The regulated provinces have colleges that set guidelines and standards of practice that must be maintained. Provincially, there are several pieces of legislation that set forth specific requirements for record keeping.

In Ontario, these are the Regulated Health Practitioners Act, Health Care Consent Act, Personal Health Information Privacy Act and Massage Therapy Act. There are also federal level agencies and legislation that apply to all provinces and territories, including the Canada Revenue Agency (CRA) and Personal Information Protection and Electronic Document Act.

|

|

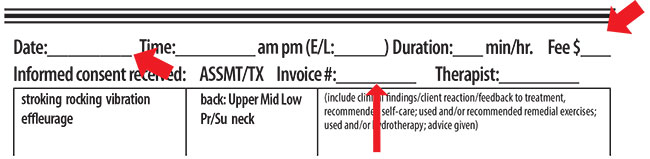

| Image 1: Sample client financial record

|

Compliance vs. best practice

Compliance means following outlined regulations or face fines or disciplinary action. Best practice is choosing to raise your minimum standard above compliance, and you could choose to do this for many reasons. This could be to make your process more in-depth, seeking more information to elevate your understanding of the client’s health picture, or getting more information about your business practice to help you make decisions to improve your bottom-line. As a profession, by elevating our own standards we can gain credibility amongst other health-care practitioners and benefit our profession going forward.

There are two aspects to financial records: those related to each client and those for your overall financial picture.

Sign up to get the latest news and events from Massage Therapy Canada.

For your clients, you are required to keep a client financial record. This must contain the particulars of the treatment rendered, the fee charged for the services provided and a copy or record of the receipt issued for payment of the services provided. This information should be part of the health information for each client. You may choose to keep all the information in one place (as shown in the image below) or maintain the information in separate locations – provided there is identifiable connector between the two files. This is to help differentiate two clients with the same name and could be as simple as using the client’s name and address on all files.

Writing receipts

Be aware of how to set up and write receipts. Receipts have to comply with regulatory standards and federal standards. A receipt is a legal document that acknowledges an exchange of goods or services has taken place and the date it transpired. This is important when you need to figure out what needs to be recorded.

|

|

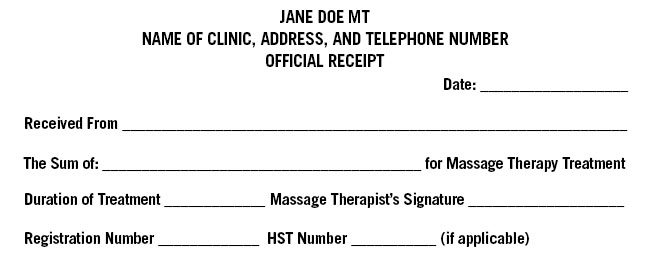

| Image 2: Sample CMTO-compliant receipt

|

Some provinces require specific information on a receipt. Important components are clinic information, date, specifics on treatment (duration and cost), your GST/HST number (if applicable), your name, registration number and your signature. Your signature on your receipts indicates the information is accurate and not a misrepresentation of what actually transpired.

Receipts and best practice

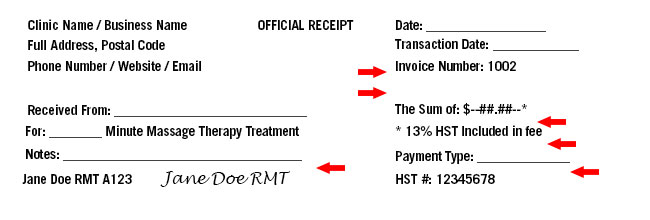

In the last number of years insurance fraud has been on the rise and insurance companies have given some suggestions to help reduce fraud. In an article published in the spring/summer 2010 issue of the College Standard (now called Touch Point), and can be found on the CMTO’s website, one insurance company gave suggestions on how to reduce the potential for fraud. From the suggestions in the article we can develop the best practice receipt. Additional elements that are recommended are:

- add a transaction date if the date of the service is different than the date of payment

- use numbered receipts to prevent clients from duplicating them

- add payment type – this will also help your accounting tracking, so it has a dual purpose

- have space for a “notes” section for various scenarios that can come up

- put your name as registered with the college to make verifying easier

- avoid handwritten receipts – but if you must, please write clearly, and add lines in front of all amounts to prevent tampering (by adding to or revising the amount) by clients

The final note is a requirement of the CRA if you are charging HST/GST (compliance, not best practice). If there is HST/GST being charged, your number must appear on the receipt. If the sale is more than $30 you must include the specific amount of HST/GST that was charged (fee broken down) or indicate there is a percentage of the amount that is for GST/HST. The sample best practice receipt (Image 3) shows 13 per cent HST was included in the fee (Ont., N.B. and N.L.)

Business expense

If you are self-employed you can take advantage of business expenses you can write off against your income, reducing the amount that you claim as income and therefore pay less in taxes. For a full list of expenses and how to write them off, seek advice from an accountant.

|

|

| Image 3: Sample best-practice receipt

|

One piece of record keeping with expenses is the “vehicle log.” If you own a car and use it for business you should be keeping a log of your mileage. This will help your accountant determine which method to use when applying these expenses to your taxes. It could be as simple as a dollar store notepad with dates, purpose (personal or business – include where you went, i.e. bank), and starting and ending mileage. This little habit could potentially reduce your taxes paid for the year.

One more note on taxes is regarding the GST or HST, depending on what province you province you practice. The GST/HST is a voluntary goods and services tax – until you earn (bill your clients) in excess of $30,000 over four consecutive calendar quarters. The government is quite specific about when you must start to collect this tax and you need to be aware of this threshold or you could be giving part of your income away if you have not accounted for it.

Once you reach the threshold of $30,000 you must start charging the GST/HST and collecting it for the government. You have 30 days to apply to the CRA for your number. Remember, GST/HST is not your income; you are merely collecting a tax that is then remitted to the government (less what you have paid out in expenses) monthly, quarterly or annually, depending on how much you collect.

This is just a very brief overview about the GST/HST, and you should seek the advice of an accountant or contact the CRA for further inquiries and clarifications.

The next article will look at the general record keeping practices that we need to be aware of for compliance and some suggestions for best practices. (Author’s note: This article primarily covers the Ontario regulations. Other regulated provinces have similar regulations. However, to ensure you are compliant with the correct regulations please consult your local acts or legislation.)

Andrea Collins is an author, educator, speaker and registered massage therapist. Contact her at andrea@rmthelp.ca.

This article was originally published in the Spring 2015 edition of Massage Therapy Canada (Web:2015-04-10)

Print this page